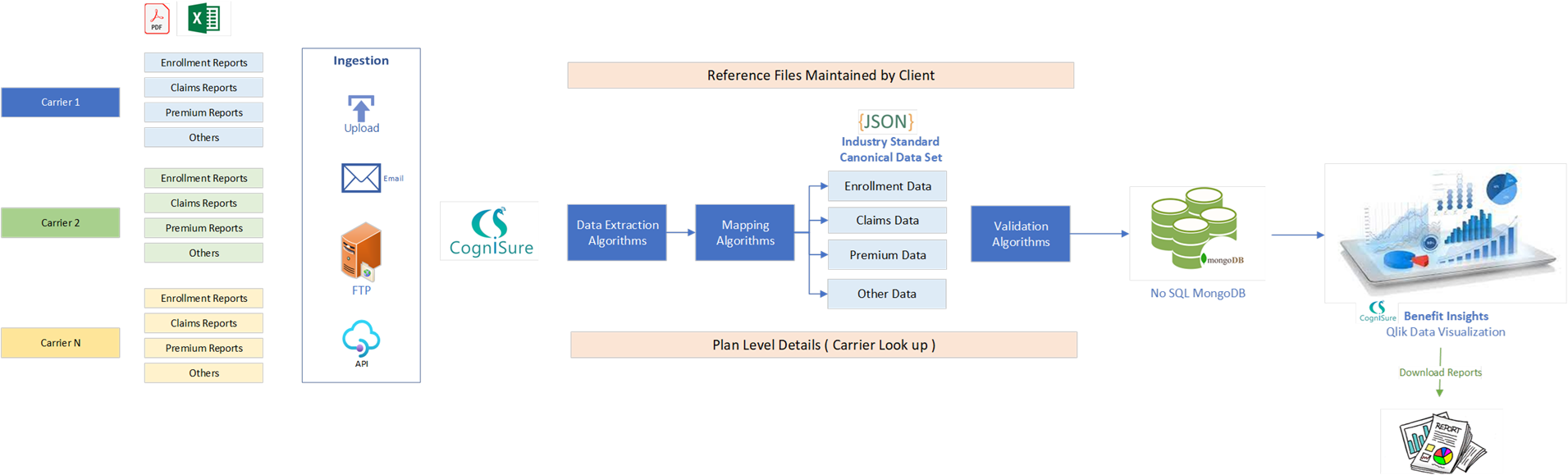

CogniSure Benefit Insights Automates the End to End Process of Employee Benefits

For self-funded employers, benefit plan claim reporting remains a major pain point. In representing our clients, we get a myriad

of unstructured data from health plans and insurers that makes data evaluation time consuming and complex. It takes hundreds of hours of manual

manipulation to harmonize reams of disparate reports and turn them into actionable data points to help clients better manage self-funded plans.

Thankfully, CogniSure AI has revolutionized this archaic process

with their new Benefit Insights solution. Their platform systematically merges data from multiple vendors across multiple lines and creates a powerful

web-based data set we can use to help clients implement strategies to bend the cost curve