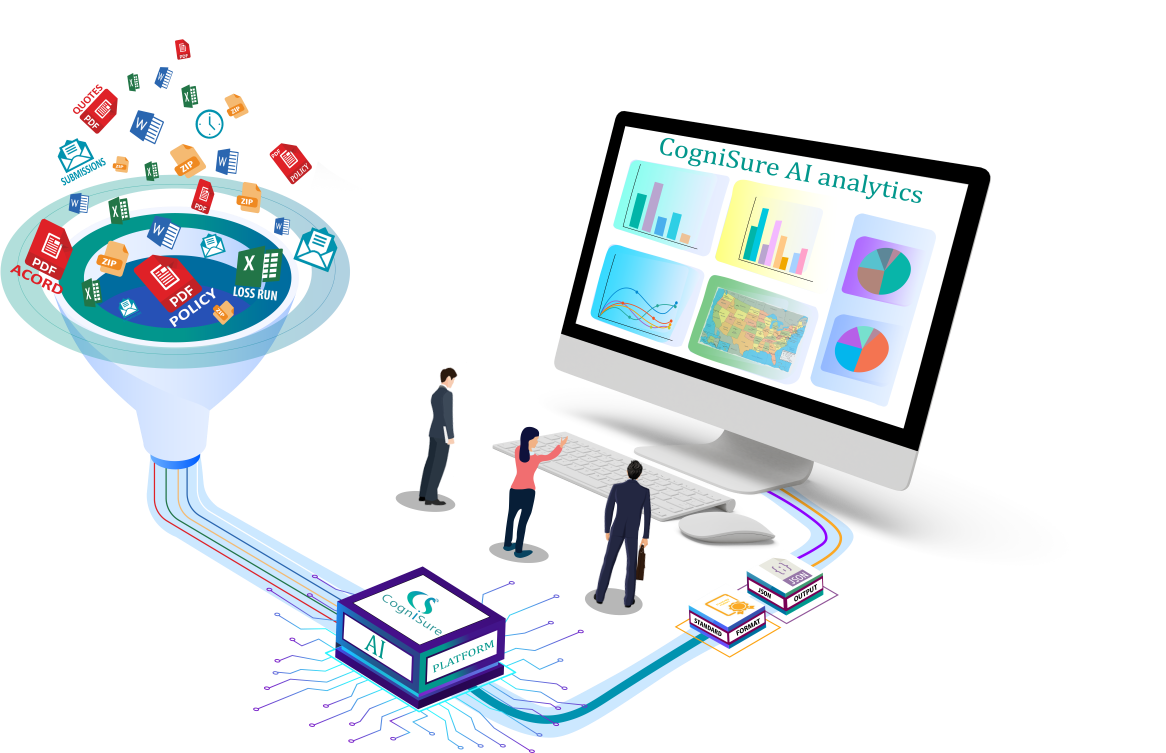

The CogniSure AI platform unlocks valuable insights trapped in unstructured data present in Property & Casualty and Health Insurance documents.

Its deep learning algorithms transform data into structured data that can be integrated with Guidewire, Duck Creek & legacy systems via RESTful API to provide actionable insights.

WE EXTRACT DATA from UNSTRUCTURED DOCUMENTS

Purpose built AI Platform for Insurance Industry with pre-built trained algorithms